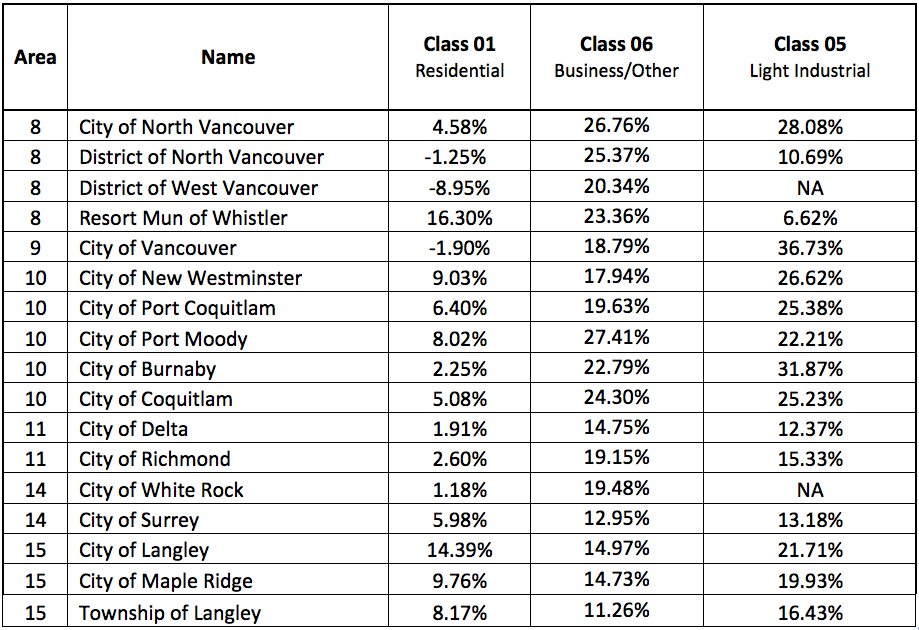

2019 Property Assessment Value Changes

The chart below details the % difference of the value change for each class between July 2017 and July 2018, in BC Assessment's opinion.

The total amount of assessed value has increased as indicated on the table below. In general terms, that should result in a decrease in the tax rate (mill rate). Therefore, just because your assessment went up, it does not mean that the taxes will. That will only happen if your increase is above average (municipal increases excluded). With no assessment increase for your property, taxes could well go down.

The question is whether the increase is correct. If your increase is greater than average, then an appeal should be considered. Even if it is within a range of the average increase, it could still be high as it may have been high last year. Also, your property should be equitably assessed to your neighbours. Please contact us if you have any questions regarding your assessments or wish us to review your property.